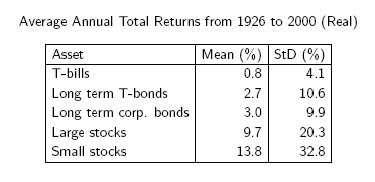

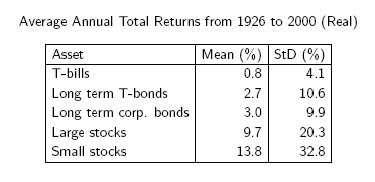

It is clear why stocks are considered the best way to build wealth.

Know when to enter and exit stock markets with the weekly update for the S&P500 index. Avoid market crashes and improve your returns. Best of all, there is no guess work and no need to lose any sleep over stock markets.

The Content does not constitute an offer, solicitation or recommendation to acquire or dispose of any investment or to engage in any other transaction.

You should always bear in mind that, the value of investments and any income from them may go down as well as up. You may not get back all of your original investment. Past performance is not necessarily a guide to future performance. All stock market based investment is exposed to a degree of risk. We recommend consulting a financial advisor before making investment decisions.

No comments:

Post a Comment